Reverse Calendar Spread – So, the Calendar spread has to be initiated and closed as a combined strategy only. The concept of a Reverse Calendar Spread is more popular when you trade on calendars in options. Her is how the . The long put calendar spread is a strategy designed to profit from a near-total coma in the underlying shares. Employing two different put options spread across two calendar months — with a .

Reverse Calendar Spread

Source : www.youtube.com

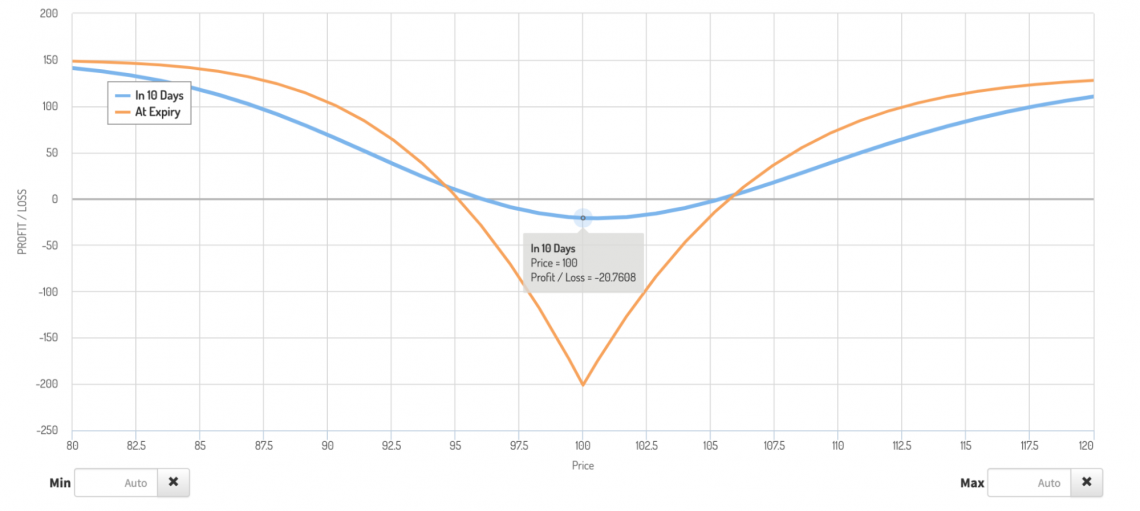

Reserve Calendar Spread What does it mean, and how to use it

Source : www.wallstreetoasis.com

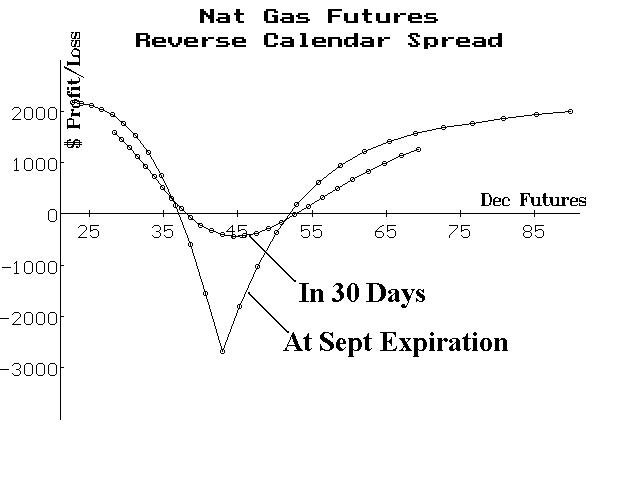

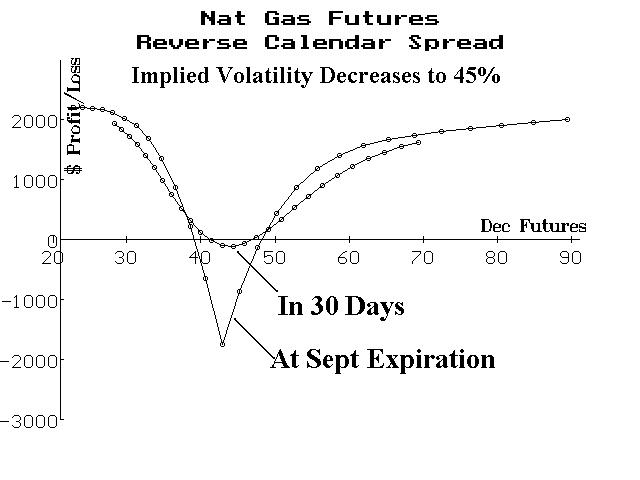

Reverse Calendar Spreads (09:12) | Option Strategist

Source : www.optionstrategist.com

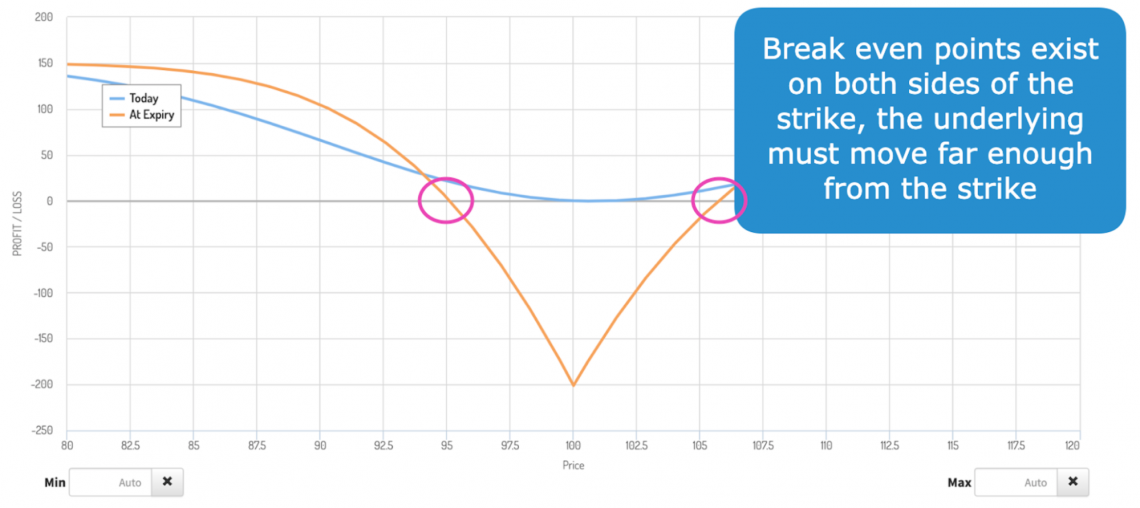

Options Trading Strategies: Exploring the Reverse Calendar Spread

Source : fastercapital.com

Reserve Calendar Spread What does it mean, and how to use it

Source : www.wallstreetoasis.com

Reverse Calendar Spread: A Profitable Options Strategy for Savvy

Source : fastercapital.com

Reverse Calendar Spreads (09:12) | Option Strategist

Source : www.optionstrategist.com

Options Trading Strategies: Exploring the Reverse Calendar Spread

Source : fastercapital.com

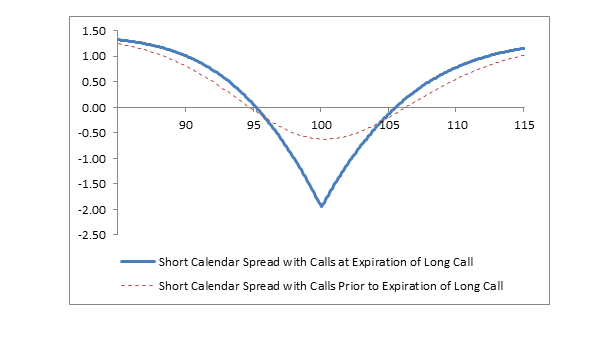

Short Calendar Spread with Calls Fidelity

Source : www.fidelity.com

CBOE Volatility Index Futures Reverse Calendar Spreads | news.cqg.com

Source : news.cqg.com

Reverse Calendar Spread Reverse Calendar Spread using Call Options YouTube: Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati . The long call calendar spread is engineered to allow you to profit from fluctuations in time value. A so-called horizontal spread, the trade involves the sale of a shorter-term call and the .