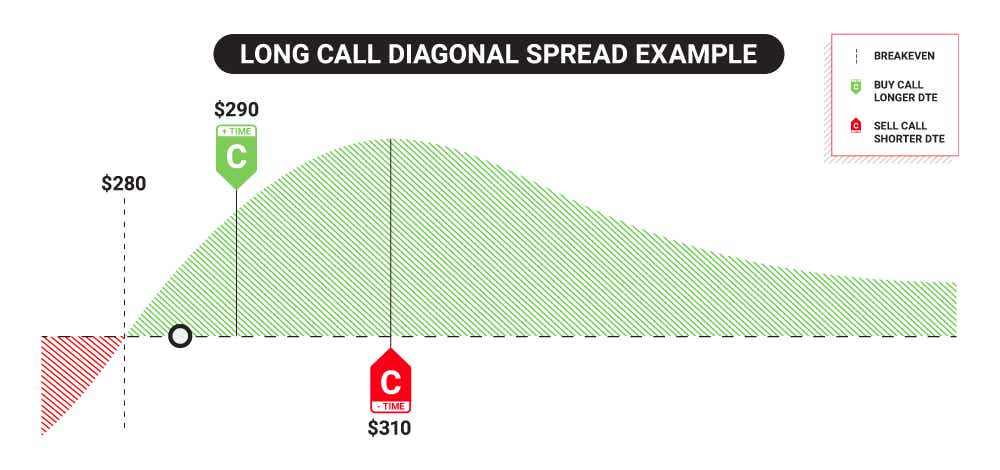

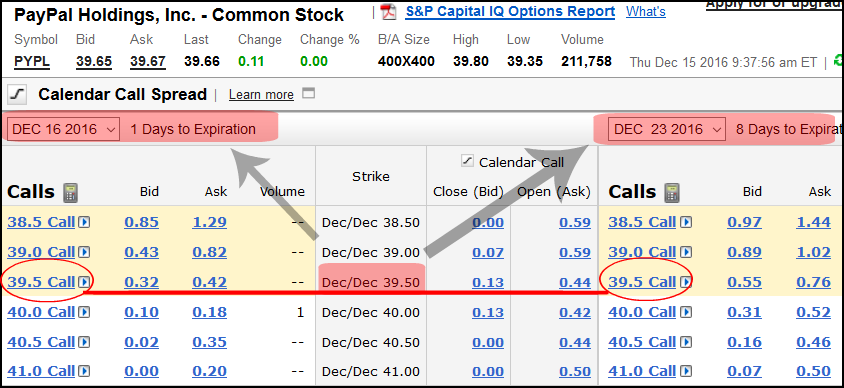

Diagonal Calendar Spread – A diagonal call spread is an options strategy that is often called a poor man’s covered call. They are financial transactions where the investor selling the call options owns the same amount of . A calendar spread, as the name suggests is a spread strategy wherein you trade on the gap between two similar contracts rather than betting on the price. This is considered to be relatively low .

Diagonal Calendar Spread

Source : www.myespresso.com

Diagonal Spread: How it Works & How to Use it | tastylive

Source : www.tastylive.com

The Poor Man’s Covered Call (and other Calendar Spreads) : r

Source : www.reddit.com

Call Diagonal Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

Calendar Spreads vs. Diagonal Spreads

Source : www.great-option-trading-strategies.com

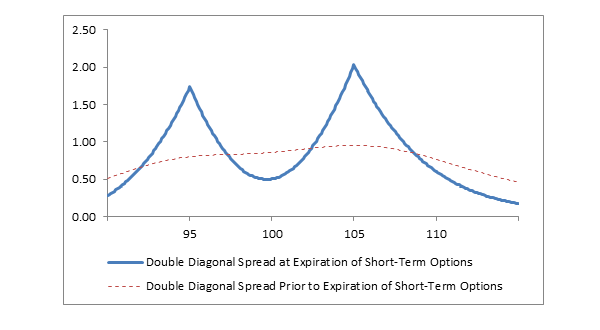

What Is Double Diagonal Spread? Fidelity

Source : www.fidelity.com

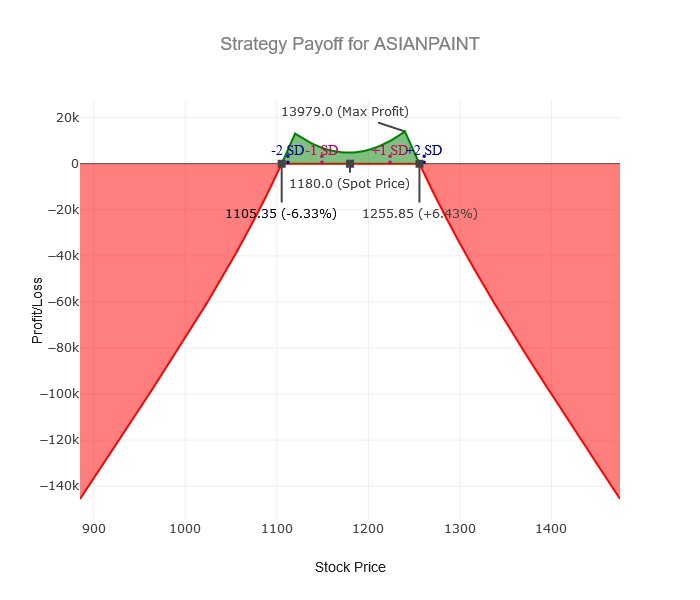

Raghunath on X: “Entered a double diagonal ratio calendar spread

Source : twitter.com

Diagonal Spread: How It Works, Trading Strategy, And Importance

Source : www.strike.money

The Ultimate Guide to Double Diagonal Spreads

Source : optionstradingiq.com

Diagonal Spread Options Trading Strategy In Python

Source : blog.quantinsti.com

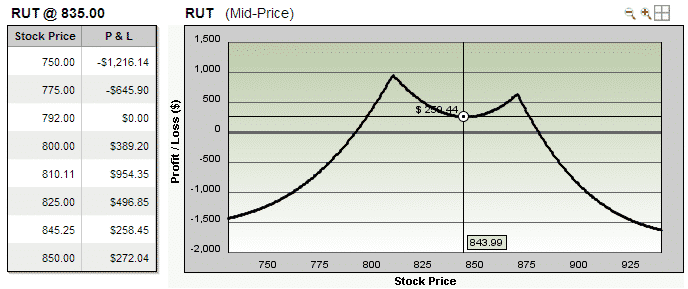

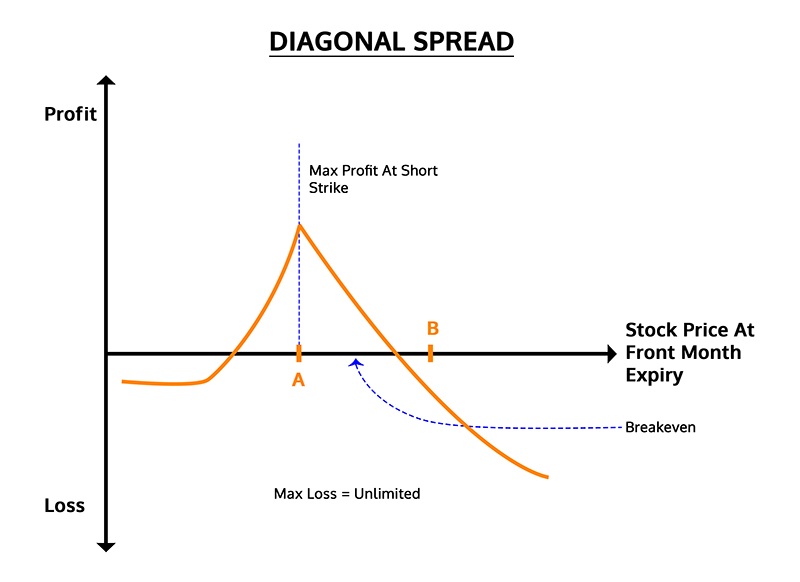

Diagonal Calendar Spread Diagonal Spread & Double Diagonal: How to construct them : Strategy: Consider a diagonal calendar bull-call spread. Initiate by selling 450-strike call (May series) and simultaneously buying 480-strike call (June contract). As these options closed with a . Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati .